Select Page

Urgent need to do things differently

The supply side of agrifood chains is confronted with challenging demands such as improving product varieties and productivity, reducing/eliminating postharvest and other losses, and ensuring soil fertility and water availability. On the other hand, consumers demand convenience, quality, safety, security, and affordability. Supply-demand dynamics are complicated by the current retail and distribution systems, leading to substantial inefficiencies and loss of value. The netchain improvement framework (NIMPF) is a tool to diagnose how chain actors can align their activities and create interventions to ensure market relevance and competitiveness for their chains/businesses. A summary of an SNV Netherlands Development Organisation project, funded by the International Fund for Agriculture Development under the overall responsibility of the Ministry of Agricultural Development and in partnership with the Agro-Enterprise Centre, in Nepal is presented to demonstrate the interventions carried out at different levels and the results achieved.

The NIMPF

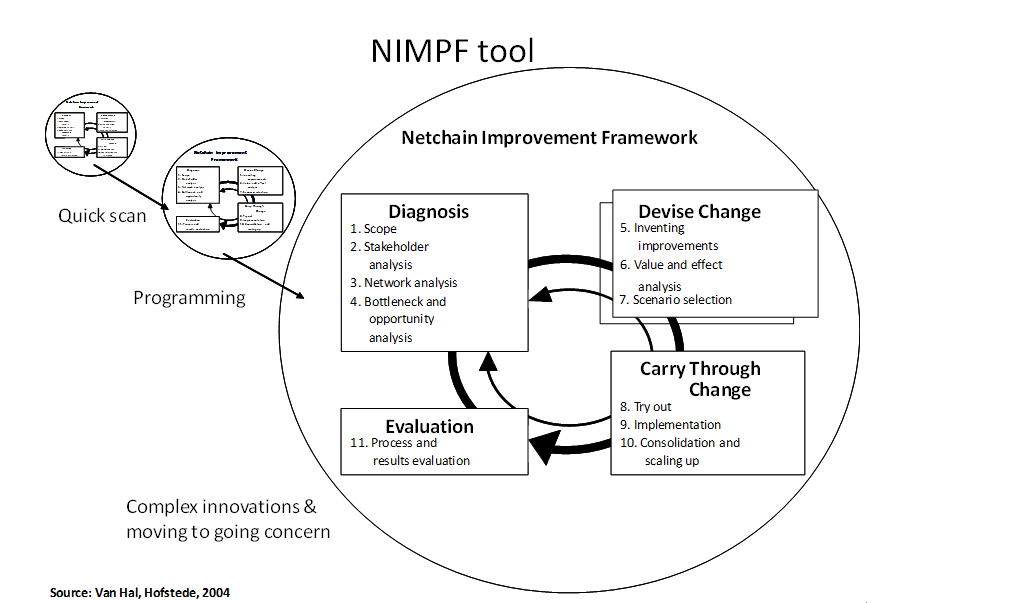

The NIMPF has improved substantially based on experience over the last decade. It involves a multicycle approach based on the plan-do-check-act cycle for continuous improvement (Figure). Each cycle contains 11 steps in four phases. The process is initiated through a quick scan to identify within a short period (hours) the most important challenges and low-hanging fruit. The subsequent cycle is a more detailed investigation to lead to an action plan for improvement, and the third cycle leads to more complex innovations and can take one to three years.

The approach is based on an iterative, interactive process gradually building trust among the chain stakeholders, allowing collective actions and chain improvement. Chain innovation moves from a project orientation toward the business-as-usual model as part of total quality management in the chain.

Figure. The Netchain Improvement Framework cycles. Reproduced, with permission, from Van Hal, P. and Hofstede, G.J., Netchain IMPRrovement Framework for chain and network diagnosis and change, 2004.

Four phases

Every cycle has four phases: 1) diagnosis; 2) device change; 3) carry through change; and 4) evaluation. Every phase has multiple steps. For every step, a different set of analytical tools can be used (for details, go to www.valuebasedmanagement.net). Depending on the context of the problem and experience of the moderator, a specific mixture of tools can be used. The added value of the NIMPF is the specific sequence of tool usage for analyzing the context.

Phase 1: diagnosis/step 1: scope

The step that defines the scope acts as a reference for all subsequent steps. It defines the value chain at macro sector/regional level or operational (micro) business-to-business (B2B) level. Scoping is directly linked to the objectives and strategy from a business perspective. In a netchain, while there is no unity of ownership, a clear delineation of crucial tasks and key stakeholders is made. In essence, this step focuses on aligning the objectives/goals of different stakeholders within the chain to work out relevant interventions.

Steps 2 and 3: stakeholder and network analyses

Chains and networks are open systems. Who are the stakeholders (Table 1)?

Table 1. Variety of stakeholders in agrifood business chains.

Step 4: bottleneck and opportunity analyses

This step finalizes the diagnosis and provides a perspective on possible solutions. It is the base for the creative part of step 5 during phase 2, which is to design the change(s) required. Here the key focus is to create a netchain that is more than sum of its parts. Experience suggests that project participants often skip a proper diagnosis phase and jump directly to step 5. However, without understanding the context, force field, etc., the success ratio during implementation is very low. During the second or third cycle, steps 1–4 can be updated quickly because in most cases the context does not change rapidly.

Phase 2: device change

In this phase, the idea is to move from the present to the desired situation and understanding the resources required to get there. Some examples of the objectives at the chain level are: optimizing transactions (speed, reliability); utilizing technology; introducing new information processing units; shifting transactions to other actors; eliminating linkages; or reorganizing actors like developing cooperatives, alliances, joint ventures, outsourcing, etc. Based on value and effect analyses (step 6) a scenario is selected (step 7).

Phase 3: carry through the change

This phase marks the start of the execution of the ideas developed during phase 2. Testing (step 8) and implementing (step 9) the ideas will lead to changing old habits and traditions or to eliminating certain activities. The major challenge is to introduce the actual change while normal business continues. This step increases the capacity of the netchain stakeholders to predict what effects the changes may have in terms of quantitative changes, changing roles, cultural differences, and effects on competencies of individuals, especially management. After implementation is completed, the next questions arise: How can the changes be consolidated? How can they be scaled up to other parts of the network (step 10)? In many cases, this will lead to a new project and a new cycle starting with step 1.

Phase 4: evaluate improvements

Before starting a new project, step 11, process and result evaluation, is important. To what extent (both qualitative and quantitative) did the previous steps contribute to the goals defined during step 1? Which effects were not anticipated and which were not included? What is the opinion of all stakeholders on the future? The output of this step is important to improve the next innovation cycle.

Moderator shift

During the multiple cycles, there may be a shift in moderators. During the quick scan, one person typically investigates the chain. This could be a chain leader or an outsider like a consultancy firm, regional innovation agency, NGO, or donor organization. During different cycles, the actors develop trust and experience win-win options. Chain innovation becomes more business as usual. The stakeholders involved change with every cycle. Generally, we see a shift toward more business involvement and fewer public actors. Operation should be “triple P (profit, people, planet)” driven so that an attractive, sustainable business model evolves and moderation shifts to the chain leader.

Results and impact

The NIMPF tool acts to align different stakeholders to increase their market relevance and competitiveness. Interviews with people experienced in food chain management suggest that clear positive tangible and intangible results are possible. The example of the SNV apple project in Nepal showed many of those results, including improved total chain performance (profitability, market position, access to capital, client-driven culture), accepted chain leadership, respect and equality between chain actors, and joint investments. The main conclusion of NIMPF experience is that future food businesses can compete effectively by being part of innovative, competitive value chains.

Apple value chain development: summary of a project in Nepal

As reported on the SNV website (www.snvworld.org), the mountainous district of Jumla is the largest apple-producing area in Nepal, with more than 10,000 smallholder farmers. Only 10% of Jumla apples made their way out of the district, while about 37,000 metric tons of apples, worth more than US$12 million, were imported from India and PR China annually.

Under the High Value Agriculture project of the Ministry of Agricultural Development in partnership with the AEC and SNV Nepal, the NIMPF tool was applied to Jumla apple production, leading to a shift from sector selection and analyses (cycles 1 and 2 in 2008–2010) to commercial business network analyses and selection (cycle 3, 2010–2012). Specifically, interventions were made through a multi-stakeholder approach which led to the design and execution of new concepts to scale up the apple business (cycle 4, 2013 and 2014). The specific interventions at the level of different stakeholders are indicated in Table 2.

Table 2. Main interventions for apple value chain development in the SNV project in Nepal. Reproduced, with permission, from SNV Nepal 2013 at www.snvworld.org.

Some documented results of the value chain improvement pilot project have been:

1) The incomes of more than 1,200 smallholder farmers increased by 200% to 300%, with 54% and 9% increases in sales of Grade A and Grade B apples, respectively.

2) The quality of apples improved through better orchard management, product grading, and organic certification.

3) The supply of Jumla apples to national markets increased and imports decreased.

4) Supplies of inputs by Nepalese agribusinesses became more reliable.

5) Two more private companies have established marketing ties with Jumla apple growers.

6) Seven of 30 village development committees (VDCs) are certified organic producers. These VDCs harvest about 1,800 metric tons of apples (35% of the total district harvest). The price at the farm gate is 40 NRS/kg; at the end market it is 150 NRS/kg (US$1 = 92 NRS).

Woody Maijers holds an MSc in Agricultural Engineering, Wageningen University. As a consultant, he worked in the field of chain and sector development (1990–1994) and as managing director of the foundation Agri Chain Competence Centre (1994–2007). Since 2003, he has been a professor of value chain management at the Inholland University of Applied Sciences in Delft, the Netherlands. In 2007, Maijers started his own company, The Value Chain Coach, focusing on training, strategic value chain development studies (B2B and sector level), and curriculum development for universities.

Woody Maijers holds an MSc in Agricultural Engineering, Wageningen University. As a consultant, he worked in the field of chain and sector development (1990–1994) and as managing director of the foundation Agri Chain Competence Centre (1994–2007). Since 2003, he has been a professor of value chain management at the Inholland University of Applied Sciences in Delft, the Netherlands. In 2007, Maijers started his own company, The Value Chain Coach, focusing on training, strategic value chain development studies (B2B and sector level), and curriculum development for universities.